All About Crypto Loans

Applying for a loan and getting it approved is a tiresome process in conventional banking systems. People have to wait for days, constantly visit the banks and fill out innumerable forms to get a loan sanctioned. Therefore, the financial industry has taken a positive turn toward adopting Fintech. Fintech facilitates digital lending and eliminates the intermediaries’ extra cost.

There are major differences between a conventional bank loan and a crypto loan. In-person visits to the bank, lengthy forms, long verification processes, pending approvals, etc; are the discomforts of applying for a loan in a conventional banking system. Even if you apply for a bank loan through an online portal, you will still have to visit the branch in person for other processes like getting the loan sanctioned and verifying the documents.

Whereas when it comes to lending from crypto loans, the process is completely automated and online. The loan application and sanction process are all done online in different ways. There are two types of crypto loans: centralized and decentralized. The main difference between these two types of crypto loans includes- who handles the crypto loans, whether it’s a smart contract or a central body, and if custodial or KYC (Know Your Customer) is used to verify the borrower’s identity. In a centralized crypto loan, one authority sanctions the loan based on custodial security, and the decentralized crypto loan is powered by a smart contract and is not dependent on any central organization to enforce loans’ terms and conditions.

Crypto loans are preferable and profitable as it increases the value of the assets in a secure way. It also saves the effort that you will have to put in otherwise while visiting the banks. Although both centralized and decentralized crypto loans function as a boon to the lending sector of finance, the decentralized crypto loan is gaining traction because of its distributed nature and non-custodial feature.

This article will take you through the nitty-gritty of crypto loans, majorly focusing on decentralized non-custodial crypto loans.

- What is a crypto loan?

- What are the various types of crypto loans?

- What are the benefits of decentralized crypto loans?

- What are the key components of decentralized crypto loans?

- How does a decentralized crypto loan work?

- What crypto-loan platform development services does Leewayhertz provide?

What is a crypto loan?

Crypto loans are the loans that a borrower avails by collateralizing their crypto assets. It provides the crypto lenders with interest payments known as the ‘crypto dividends’ in exchange for the crypto loans that they lend in the form of fiat currency. The person taking the crypto loan gets fiat loans from the lender in exchange for crypto assets or currencies like ETH or BTC. These crypto-assets and currencies then act as securities if the borrower is unable to pay them back.

Crypto loans also accentuate the value of borrowers’ crypto assets while holding them without any plans to sell them further. The crypto assets offered as collateral are not available for trading during the stipulated loan tenure. The exchange process of the crypto loans occurs between the lender and the borrower at a specific interest rate on the loan. Like traditional loans, the crypto loan amount is given to the borrower in his account, and the borrower is supposed to pay the EMIs to the person who is lending the crypto loan. Once the borrower is completely done with paying the amount, the lender then releases the borrower’s crypto assets, collateralized as loan security.

Crypto loans also function in a reverse way of what is mentioned above. In the reverse situation, the borrower will use fiat currencies as collateral to avail of crypto assets. The advantages of crypto loans are given below:

- No physical bank account

- Diversified loan portfolio

- Lender passive income

- Permissionless exchanges

- No geographic limitations

- Low transaction fees and good interest rates

Now that we are familiar with crypto loans let us explore the different types of crypto loans.

What are the various types of crypto loans?

There are two kinds of crypto loans, DeFi and CeFi loans. The basic difference between these two types is that a smart contract handles one, and the other one is under the control of an authority or a business.

Custodial CeFi crypto loans

In centralized crypto loans, the authority or the company takes care of the users’ onboarding. During this onboarding, the authority implements the KYC and exchanges cryptocurrencies and fiat currencies with the custodial to secure the assets. The centralized loan is flexible in nature when it comes to building partnerships with different businesses and negotiating custom loan contracts.

Centralized crypto loan platforms utilize margins to gain the attention of the users. They also offer attractive interest rates and agreements with crypto lenders.

Non-custodial DeFi crypto loans

Decentralized crypto-loans work as peer-to-peer loans, in which the borrowers are connected with the lenders through a Defi crypto lending platform, powered by blockchain. These types of loans are regulated by smart contracts and are not under the control of any central entity. Individual borrowers utilize their digital or crypto assets to avail of cash loans. These cash loans are then utilized as working capital.

DeFi platforms are often non-custodial, do not need KYC, and solely accept cryptocurrency. The interest rates given vary based on market supply and demand, but they are often lower than the rates supplied by centralized services of lending. DeFi is more transparent than centralized since the protocols are open to anyone and transactions are stored on public blockchains.

Let us now look at some of the benefits of decentralized crypto lending in the next section.

What are the benefits of decentralized crypto loans?

Decentralized crypto loans have the following advantages over conventional lending:

Transparency

The loan and interest regulation process of the crypto loans in DeFi is monitored by smart contracts. Therefore, the data related to DeFi crypto loans is openly available and auditable on a public blockchain for on-chain users. Furthermore, individuals’ previous transactions with the loan blockchain protocols, as well as their lent and borrowed positions, are publicly recorded on the blockchain. Everyone has an access to view the market data of the crypto loan protocol in DeFi.

Democracy

In the absence of a central authority, users vote on loan protocol modifications. Many of these protocols, in particular, distribute governance tokens to users, which provide proportionate voting rights to individuals with economic holdings in these platforms.

Liquidity

Funds provided to a lending platform are pooled and can be used profitably. Lending, borrowing, and arbitraging can all be done cheaply and quickly with the help of smart contracts on the blockchain.

Agility

DeFi loans can automatically change interest rates and continuously reflect the market’s newest supply-borrow ratio.

Trustless

Lenders no longer need to trust borrowers’ creditworthiness since effectively structured smart contracts enforce liquidation at the time of default risk.

Now that we are familiar with the benefits of decentralized crypto loans let us look at its key components in the next section.

Empower your business with DeFi apps for P2P crypto loans.

Launch your own crypto loan platform with LeewayHertz.

What are the key components of decentralized crypto loans?

Decentralized crypto loans have two specific features. First, they tend to deviate from the present subjective framework of the centralized credit assessment and collateral evaluation; second, they deploy smart contracts to monitor the crypto-assets. Decentralized crypto loans have the following key components:

Value locked

Value locked is that component that originates from the users’ deposits in a decentralized lending protocol’s smart contracts. This locked value acts as a reserve to pay back the depositor in case of redemption, and it is also used in the form of collateral.

IOU token

Decentralized crypto lending platforms issue their users IOU tokens against their deposits. These IOU tokens are then used to redeem the deposits after some time. They are transferable in nature and can be traded in exchanges.

Collateral

Decentralized crypto loan’s collateral consists of borrower’s deposits in part and in entirety. The value of the collateral, along with the underlying asset’s final loan-to-value ratio, tells about the number of crypto assets that a user is allowed to borrow.

Liquidation

The liquidity status of collateral is automatically triggered by using a smart contract. In a situation where the loan’s loan-to-value ratio crosses a critical threshold which is known as the liquidation threshold, because of the interest accrued or the various market movements, any network participant can then compete for the collateral liquidation. The market price data of the locked and the borrowed assets are given to the smart contracts via external data providers, also known as the ‘price oracles’.

Interest rate

In decentralized lending, the borrowing and lending rates are altered by smart contracts, a contract that acts as an agreement between the lender and borrower. Smart contract adjusts these interest rates as per the current supply-borrow dynamics.

Governance Token

Some of the decentralized crypto lending platforms distribute the governance tokens to their users so as to allow them to vote and propose the lending protocol changes, like the alteration of the interest rates. Governance tokens are mostly used in the form of a reward scheme to incentivize users’ participation from both lending and borrowing perspectives.

Now that we know about the specific components of decentralized crypto lending let us understand its mechanism in the next part.

How does a decentralized crypto loan work?

Decentralized crypto loans work in a way where the lenders and the borrowers are connected with the help of smart contracts that regulate the loan processes and interest rates. These smart contracts monitor both parties for security purposes. So for crypto loans on Defi, three entities are involved as follows:

Lenders

They are the ones who lend their fiat currency in the form of crypto loans to earn passively in the form of crypto dividends or the interest of the lent amount. Decentralized crypto lenders also earn from their crypto investments.

Blockchain platform

The blockchain platform takes care of the transactions that involve lending and borrowing between two parties by triggering a smart contract. It monitors all the lending factors, including the interest rate and security, in case the borrower fails to pay back. Lending protocols automate the complete process of decentralized lending without any intermediary, and it does not require revealing the identities of both parties.

Borrowers

Borrowers are people who want a certain amount of crypto loan against their crypto assets in the form of collateral. They connect with the DeFi crypto loan platform and then request for a crypto loan. The borrower offers his crypto assets as collateral for the lender’s security of the lending amount. Here, smart control takes over in managing all the technical intricacies involved in the loan process, including, collateral blocking, loan approval, and interest rate. The borrower is then bound to repay the full loan amount before taking back the crypto-assets and stakes that he has offered in his collateral.

What crypto-loan platform development services does Leewayhertz provide?

Leewayhertz focuses on businesses and entrepreneurs interested in launching their own DEFI dApps for peer-to-peer lending and borrowing of Crypto loans. It provides the following crypto-lending platform development services:

Consultancy and ideation

We provide consultancy services that will help understand the mechanism of the crypto loan platforms. Our consultancy and ideation services chart will give you an overview of various features and tools that we integrate into the lending platform.

Smart contract development

Our smart contract experts code and build smart contracts for lending and borrowing decentralized crypto loans, making them secure, trustless and permissionless.

Backend and frontend development

Our skilled developers brainstorm the structure and the design of your DeFi platform. For an easy user interface, we develop the front and backend of your lending platform by integrating the best-suited tools, admin panels and security functions.

Wallet development

We also provide wallet development services to facilitate multi-currency lending and borrowing. This helps the borrower and lender engage in a lending process that involves a spectrum of cryptos.

Stablecoin development

We also provide stablecoin development to facilitate peer-to-peer lending between lenders and borrowers. Borrowers just have to exchange the stablecoin for cash.

Customization

We build a need specific protocol for your DeFi crypto lending platform, set and alter its rules, rate of interest, LTV rate, liquidation penalty and chalk out the accepted digital currencies.

Security Enablement

To ensure the maximum security of the collaterals & crypto-assets and to secure users’ credentials, we integrate high-level encryption and security features that best-suits your P2P lending platform.

Maintenance and Upgrade

To ensure the scalability of your DeFi crypto lending platform, we engage in a constant analysis to develop new features and integrate robust technologies.

Conclusion

Decentralized crypto lending has the ability to transform the financial sector completely. Blockchain-based crypto payments, trade, investing, insurance, lending, and borrowing are all initiatives to decentralize conventional financial services. By providing attractive opportunities for passive earning from crypto assets and good interest rates on lending, DeFi has enormous potential to transform the worldwide financial environment.

If you are interested in developing a DeFi crypto-loan platform, contact our DeFi experts and professionals for further guidance.

Start a conversation by filling the form

All information will be kept confidential.

Insights

How to set up and run a full node on Polkadot?

Learn how to run a full node on Polkadot to build dApp or advanced web3 solutions on the Polkadot Network and the Polkadot-compatible Substrate framework.

How to build a Proof of Existence Blockchain with Substrate?

The Substrate is an open-source, extensible and modular framework designed for building various interoperable blockchain networks like Polkadot. Learn how to build a Proof of Existence Blockchain with Substrate

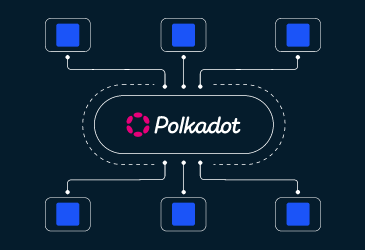

Cross-chain Web3 Applications on Polkadot

Polkadot supports the development of innovative Web3 applications on its ecosystem, enabling the enterprises to benefit from the attributes of the next-generation web.