Fintech Software Development Company

Leveraging our industry knowledge and advanced technologies, including AI and generative AI, we build software solutions that help optimize BFSI workflows, enhance customer experiences, and improve operational efficiency. Our goal is to empower clients to streamline and improve their fintech operations, fostering heightened efficiency and competitiveness through carefully crafted, high-tech software solutions.

Trusted By Leading Enterprises

Our Fintech Software Development Services

Strategic Consulting

PoC and MVP Development

Custom Fintech Software Development

AI-powered Fintech Solutions

System Modernization

UI/UX Design

QA and Testing

Finance AI Agent Development

Web 3 Integration

Support and Maintenance

Custom Fintech Solutions We Build

Investment Management Solutions

We build custom investment management solutions, providing investors with potent tools to streamline and optimize their strategies. Our offerings include customized investment platforms, asset management systems, and advanced analytics and reporting tools, empowering clients with advanced solutions tailored to their unique needs.

Data Analytics Systems

Our team builds data analytics platforms that leverage AI to provide actionable insights into customer behavior, market trends, and risk assessment. Our data analytics solutions aid in making informed decisions and developing targeted strategies, empowering businesses to optimize operations and drive growth based on data-driven intelligence.

Insurtech (Insurance Technology) Solutions

Our team of developers specializes in developing a wide range of insurance solutions, encompassing insurtech platforms, claims management systems, peer-to-peer insurance, and more. Our software solutions are specifically designed to optimize underwriting processes, streamline claims management, and enhance overall customer experience.

RegTech (Regulatory Technology) Solutions

We craft RegTech solutions that assist financial organizations in complying with complex regulations and reporting requirements. Our solutions automate compliance processes, reduce errors, and ensure adherence to legal standards, empowering organizations to manage regulatory obligations and mitigate compliance risks efficiently.

BFSI Service Platforms

We create secure and scalable web platforms that facilitate complex multi-party financial activities, including trading, investing, and currency exchange. Our payment and transaction processing solutions empower seamless and efficient financial operations, ensuring reliability and security for users engaging in diverse financial activities.

Digital Payment Solutions

We create secure and user-friendly digital payment ecosystems encompassing mobile wallets, contactless payment systems, and peer-to-peer money transfer applications. Our solutions facilitate smooth transactions and elevate user convenience by providing seamless and efficient payment experiences across various platforms and devices.

Wealth Management Solutions

Our team of developers builds efficient, secure and feature-packed wealth management software that facilitates the secure tracking, management, and growth of wealth. Our solutions prioritize data security and seamless functionality to empower users to manage their financial assets effectively and achieve their investment goals.

Financial Fraud Detection Systems

We build advanced financial fraud detection systems designed to identify and prevent fraudulent activities in real time. Our systems utilize sophisticated algorithms and machine learning techniques to analyze transaction patterns and flag unusual behaviors, helping financial institutions minimize risk and protect their customers.

AI Chatbots and Virtual Assistants

Our team creates robust AI chatbots and virtual assistants tailored for the BFSI sector, enhancing customer service experiences. These intelligent virtual helpers can answer inquiries, assist with issue resolution, and provide 24/7 support, all through conversational interfaces that integrate seamlessly with existing customer service channels.

Process Automation Solutions

Compliance Monitoring Systems

We develop robust compliance monitoring systems that ensure financial institutions can adhere to regulatory requirements. Our systems are engineered to monitor and report on compliance issues automatically, providing continuous oversight and helping businesses stay ahead of potential compliance risks.

Client-facing Apps

Our team develops client-facing apps that offer self-service options and deliver seamless digital experiences for customers of financial services providers. We specialize in creating mobile banking apps, money lending apps, payment apps, and insurance apps tailored to enhance customer engagement and satisfaction.

Banking Solutions

Our team specializes in developing comprehensive banking solutions that drive your bank’s digital transformation, covering payment processing solutions, mobile banking apps, customer portal development, and more. We excel in creating secure and user-friendly mobile banking applications, delivering seamless operations and an enhanced customer experience through custom web and mobile banking solutions and integrated payment systems.

Sophisticated Processing Systems

We develop large-scale systems designed specifically for the BFSI sector, featuring comprehensive processing engines at their core. These robust systems are tailored to handle complex operations, optimizing performance, enhancing operational efficiency, and meeting the unique needs of financial institutions. Our specialized solutions include loan processing systems, mortgage systems, claim processing systems, and core banking systems.

Peer-to-peer Marketplaces

We develop innovative online platforms that connect financial service providers, including private investors, with individuals and small to medium-sized businesses (SMBs) in need of funding and financial services. Our expertise spans creating cutting-edge solutions like peer-to-peer (P2P) lending software, P2P insurance platforms and crowdfunding platforms designed to streamline the financial ecosystem, making it more accessible and efficient for all parties involved.

Why Choose Our Fintech Software Solutions?

User-friendly Design

Our software solutions prioritize user-friendly design, offering intuitive interfaces crafted for effortless financial operations. With a focus on simplicity and ease of navigation, we ensure a seamless user experience that simplifies processes, optimizes functionality and enhances usability.

Seamless Integration

Our fintech solutions seamlessly integrate with third-party software, enhancing the versatility and functionality of your operations for comprehensive and connected financial management. This integration facilitates a unified experience, enabling efficient data sharing, expanded capabilities, and optimized workflows to meet the diverse needs of your business.

Cross-platform Accessibility

Our software is designed to be accessible across multiple platforms, ensuring compatibility with various devices and operating systems to reach a broader audience of users. This multi-platform support enhances user experience and engagement by allowing seamless access whether on desktop, tablet, or mobile, ensuring that all users can efficiently interact with our solutions.

Scalable Architecture

Our solutions are built with scalable architecture, ensuring they can grow alongside your business and adapt to increasing demands and evolving requirements. This scalable approach allows for seamless expansion and flexibility, empowering your business to thrive in dynamic environments and effectively meet future challenges.

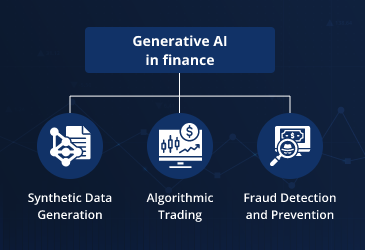

AI-powered Innovation

Our fintech software integrates advanced AI features to enable smart automation, predictive analytics, and enhanced functionalities within your financial app. By harnessing the power of AI, we empower your app to deliver personalized insights, optimize processes, and provide exceptional user experiences, ultimately driving efficiency.

Strategic Data Insights

Our software solution empowers users with data-centric capabilities, providing extensive access to information and fostering informed decision-making. Our solution delivers actionable insights that guide financial success and drive informed decision-making.

Why Partner With LeewayHertz for Fintech Software Development?

Technical and Development Expertise

We specialize in customized fintech software development, harnessing AI, ML, blockchain, and other cutting-edge technologies to tackle financial technology challenges. With extensive expertise and a proven track record, we ensure your fintech solution stands out, meets your specific needs, and delivers measurable results.

Extensive Experience

We have a well-established track record in the fintech sector, backed by years of experience in designing and deploying advanced financial solutions. Our portfolio spans a diverse range of projects, from developing intricate blockchain applications to crafting efficient digital payment systems and comprehensive regulatory technology solutions.

Agile Development Methodology

We embrace the agile development methodology to build AI-powered fintech software solutions, promoting flexibility and responsiveness. Our iterative approach prioritizes continuous enhancements, ensuring your solution adapts seamlessly to evolving industry demands.

Quality Assurance

We uphold the highest quality standards throughout our process. From initial ideation to final deployment, we adhere to rigorous testing protocols and industry best practices, ensuring that your fintech solution is not only functional but also robust, secure, and intuitive for users.

Timely Delivery

Robust Security

We prioritize the confidentiality and integrity of your financial data with our robust security measures, ensuring strict compliance with industry standards and regulations. You can trust in our commitment to safeguarding your sensitive information throughout every stage of development and deployment.

Our Fintech Software Development Process

We begin with a meticulous blueprint, laying the strategic foundation for a seamless and innovative development lifecycle.

Planning and Requirement Gathering

- Initial Consultation: We initiate a detailed discussion to comprehend your business goals, target audience, pain points, and desired functionalities for the fintech solution.

- Market Analysis and Insights: We explore the current market landscape, identify opportunities, and analyze existing solutions to ensure the solution we provide enhances your competitive position in the market.

- Project Scope Definition: We collaborate with you to define the project’s scope and ensure that all objectives are clearly identified and aligned with your business goals and budget.

Solution Design and Prototyping

- Concept Brainstorming: We ideate and present multiple solution concepts that align precisely with your goals and budget.

- Technical Architecture Planning: Define software architecture, technology stack, and security protocols based on your unique needs and scalability requirements.

- UI/UX Design: Craft intuitive and user-friendly interfaces to ensure a seamless experience for your target audience.

- Prototyping: Develop low-fidelity and high-fidelity prototypes for continuous testing, feedback, and iterative refinement.

Development and Testing

- Agile Development: Employing an agile methodology, we break down the project into manageable sprints, incorporating your feedback at each stage.

- Secure Development Practices: We implement secure coding practices and robust security measures throughout the development process.

- Automated Testing: Utilize automated testing frameworks to ensure code quality, functionality, and performance.

- UAT Implementation: Conduct extensive User Acceptance Testing (UAT) with your team and end-users to meet expectations and address real-world scenarios.

Deployment and Maintenance

- Smooth Deployment and Launch: We work closely with you to deploy the solution in your chosen environment (cloud or on-premises) for a smooth launch with minimal disruption.

- Ongoing Technical Support and Maintenance: Provide continuous technical support to address post-deployment issues and ensure optimal functionality.

- Security Updates and Compliance: We stay vigilant about evolving security threats and regulations, implementing necessary updates to ensure compliance with financial regulations.

- Post-launch Analysis and Optimization: Gather user feedback and data for performance analysis, identifying areas for improvement and collaborating with you to implement updates for enhanced user experience.

Tech Stack

We prioritize technologies enabling the creation of agile and secure solutions. Every solution we develop is cloud-deployable, ensuring enhanced efficiency and continuous availability.

| Front-end |      |

| Back-end |       |

| Big Data |

|

| Database |    |

| Servers |    |

| DevOps |     |

| DL Frameworks |       |

| Modules/Toolkits |    |

| Libraries |       |

We are System Integrator for Fintech Companies

Fraud Detection Software

Financial fraud detection software is designed to protect financial institutions and systems from money laundering, counterfeiting, embezzlement, fraud and other abuses.

Financial Reporting Software

Financial reporting software is used by financial companies and banks to automate tasks of reporting financial results, transactions and status.

Background Check Software

Background check software is used to authenticate confidential information provided by individuals and organizations to process any application or credits.

Financial CRM Software

Financial CRM software is used by insurance companies, banks and credit unions to manage and organize customer information, including transaction history and contact details.

Sales Forecasting Software

Sales forecasting software is designed to plan, estimate and predict expenses with analysis and modeling tools.

Financial Risk Management

Financial risk management helps evaluate and monitor credit and market risks for banks and financial institutions.

Big Brands Trust Us

Our Engagement Models

Dedicated Development Team

Our developers leverage cutting-edge cognitive technologies to deliver high-quality services and tailored solutions to our clients.

Team Extension

Our team extension model is designed to assist clients seeking to expand their teams with the precise expertise needed for their projects.

Project-based Model

Our project-oriented approach, supported by our team of software development specialists, is dedicated to fostering client collaboration and achieving specific project objectives.

Get Started Today

1. Contact Us

Fill out the contact form protected by NDA, book a calendar and schedule a Zoom Meeting with our experts.

2. Get a Consultation

Get on a call with our team to know the feasibility of your project idea.

3. Get a Cost Estimate

Based on the project requirements, we share a project proposal with budget and timeline estimates.

4. Project Kickoff

Once the project is signed, we bring together a team from a range of disciplines to kick start your project.

Start a conversation by filling the form

Once you let us know your requirement, our technical expert will schedule a call and discuss your idea in detail post sign of an NDA.

All information will be kept confidential.

Frequently Asked Questions

What is fintech software?

What does LeewayHertz, as a fintech software development company, do?

How can fintech software solutions benefit my business?

What types of fintech software do you develop?

Does LeewayHertz provide end-to-end fintech software development services?

How do I collaborate with LeewayHertz for custom fintech software development?

Collaborating with LeewayHertz for custom fintech software development is a seamless process. Reach out to us and our dedicated team will guide you through the onboarding process, understanding your requirements and proposing tailored solutions. We prioritize clear communication and collaborative project management to ensure the success of your Fintech venture.