Wrapped tokens: An innovative approach to interoperability

With a current market cap value of $3.13 billion, wrapped tokens have gained major traction in the blockchain industry. Blockchain protocols like Ethereum, Solana and Bitcoin have different ecosystems based on their consensus algorithms. Because of different consensus algorithms, it becomes difficult for blockchain protocols to communicate. Although the unique consensus algorithms of these blockchain protocols preserve the security and sovereignty of the decentralized networks, it definitely hinders the interoperability of the blockchain.

For example, the DeFi industry requires a seamless and spontaneous movement of funds throughout the decentralized financial chain. This is exactly where wrapped tokens come in. For most advanced blockchains like Polkadot and Algorand, interoperability is not an issue, but for the first- and second-generation blockchains, facilitating cross-chain transactions and communication is not easy. Wrapped tokens allow seamless transactions and interaction among chains like Bitcoin and Ethereum.

This article will focus on the fundamentals of wrapped tokens, their features, wrapped token development opportunities and a list of commonly used wrapped tokens.

- What are the wrapped tokens?

- What are the benefits of wrapped tokens in DeFi?

- What are the components of wrapped tokens?

- The most popular wrapped tokens in DeFi

- Wrapped-token-development-opportunities

What are wrapped tokens?

Wrapped tokens are digital assets that are a representation of other assets, such as cryptocurrencies or traditional assets like gold or real estate. They are created by “wrapping” the underlying asset into a blockchain-based representation, which can then be bought, sold, and traded on digital asset exchanges and used in decentralized finance (DeFi) applications.

It’s unclear who first invented wrapped tokens, as the concept has evolved over time and has likely been developed by multiple individuals and teams working independently. However, the term “wrapped token” is often used to refer specifically to tokens created on the Ethereum blockchain using the ERC-20 standard, developed in 2015.

One of the primary benefits of wrapped tokens is that they allow for the transfer and trading of assets that may not have been previously possible or practical to do so in a decentralized way. For example, gold is a valuable asset but is difficult to transfer and trade digitally without the use of intermediaries. By wrapping gold into a digital asset, it becomes easier to transfer and trade it in a decentralized manner.

Similarly, wrapped tokens can be used to represent traditional assets like real estate or stocks. This can allow for the creation of new investment opportunities and the ability to trade these assets in a more efficient and secure manner.

Wrapped tokens can be created on various blockchain platforms, such as Ethereum, by following a specific set of rules and using smart contracts. The most common type of wrapped token is the ERC-20 token, which is created on the Ethereum blockchain and follows a specific set of rules and standards.

One of the key features of wrapped tokens is that they are backed by the underlying asset, which means that the value of the wrapped token is tied to the value of the underlying asset. For example, if a wrapped token represents one gram of gold, the value of the wrapped token will be based on the current market price of gold. This provides a level of stability and security for investors, as the value of the wrapped token is not dependent on the success or failure of a particular project or company.

Wrapped tokens are increasingly being used in decentralized finance (DeFi), a growing movement that aims to provide financial services in a decentralized and open manner. DeFi applications allow for the creation of new financial instruments and the ability to trade and invest in a decentralized manner. Wrapped tokens are a key component of many DeFi applications, as they represent and transfer various assets in a secure and transparent manner.

What are the benefits of wrapped tokens in DeFi?

Decentralized finance (DeFi) is a growing movement aiming to provide decentralized and open financial services using blockchain technology and smart contracts. As mentioned above, wrapped tokens are digital assets that are representations of other assets and are a key component of many DeFi applications, as they allow for the representation and transfer of various assets in a secure and transparent manner.

Here are some of the benefits of wrapped tokens in DeFi:

Increased accessibility

Wrapped tokens can allow for the representation and transfer of assets that may not have been possible or practical to trade in a decentralized manner before. This can increase the accessibility of certain assets and create new investment opportunities. For example, wrapped tokens can be used to represent traditional assets like real estate or stocks, which can allow for the creation of new investment opportunities and the ability to trade these assets in a more efficient and secure manner.

Improved security

Wrapped tokens are created using smart contracts, which are self-executing contracts with the terms of the agreement written directly into the code. This can provide a higher security and transparency level than traditional financial instruments. Additionally, wrapped tokens are backed by the underlying asset, which means that the value of the wrapped token is tied to the value of the underlying asset. This provides a level of stability and security for investors, as the value of the wrapped token is not dependent on the success or failure of a particular project or company.

Increased liquidity

Wrapped tokens can increase the liquidity of certain assets by allowing them to be easily bought and sold on digital asset exchanges. This can make it easier for investors to buy and sell assets, which can lead to more efficient price discovery and increased market activity.

Lower costs

Wrapped tokens can reduce the need for intermediaries, which can lower the overall cost of financial transactions. Additionally, DeFi applications often do not require users to go through the same lengthy and expensive onboarding processes as traditional financial institutions, which can further reduce costs for users.

Increased efficiency

Wrapped tokens can facilitate faster and more efficient transfer and settlement of assets, reducing the need for intermediaries and reducing the risk of errors or fraud. This can make financial transactions quicker and more convenient for users.

In addition to these benefits, wrapped tokens can also be used in a wide range of DeFi applications, such as lending and borrowing platforms, stablecoins, prediction markets, and more. These applications can allow for the creation of new financial instruments and the ability to trade and invest in a decentralized manner.

What are the components of wrapped tokens?

There are several components that make up wrapped tokens:

An underlying asset

Wrapped tokens represent an underlying asset, which can be a cryptocurrency, a traditional asset, or even a non-fungible token (NFT). The underlying asset provides the value and backing for the wrapped token.

Smart contract

Wrapped tokens are created using smart contracts, which are self-executing contracts with the terms of the agreement written directly into code. The smart contract specifies the rules and standards for the wrapped token, including how it can be created, transferred, and destroyed.

Blockchain platform

Wrapped tokens can be created on various blockchain platforms, such as Ethereum or Binance Smart Chain. The choice of a blockchain platform can impact the features and capabilities of the wrapped token.

Token standard

Wrapped tokens often follow a specific token standard, such as the ERC-20 standard on the Ethereum blockchain. The token standard specifies the rules and standards that the wrapped token must follow, including how it can be created, transferred, and destroyed.

Digital asset exchange

Wrapped tokens can be bought and sold on digital asset exchanges, which provide a platform for trading and liquidity. The choice of exchange can impact the accessibility and liquidity of the wrapped token.

The most popular wrapped tokens in DeFi

Here is a list of some wrapped tokens that are commonly used in DeFi:

WBTC (Wrapped Bitcoin)

WBTC is a wrapped token that represents Bitcoin and is created by wrapping Bitcoin into a blockchain-based representation on the Ethereum blockchain. WBTC allows Bitcoin to be used in DeFi applications and can be bought, sold, and traded on digital asset exchanges.

WETH (Wrapped Ethereum)

WETH is a wrapped token that represents Ethereum and is created by wrapping Ethereum into a blockchain-based representation on the Ethereum blockchain. WETH allows Ethereum to be used in DeFi applications and can be bought, sold, and traded on digital asset exchanges.

WXRP (Wrapped XRP)

WXRP is a wrapped token that represents XRP and is created by wrapping XRP into a blockchain-based representation on the Ethereum blockchain. WXRP allows XRP to be used in DeFi applications and can be bought, sold, and traded on digital asset exchanges.

WGLD (Wrapped Gold)

WGLD is a wrapped token that represents gold and is created by wrapping gold into a blockchain-based representation on the Ethereum blockchain. WGLD allows gold to be used in DeFi applications and can be bought, sold, and traded on digital asset exchanges.

WSTABLE (Wrapped Stablecoins)

WSTABLE is a wrapped token representing a basket of stablecoins created by wrapping stablecoins into a blockchain-based representation on the Ethereum blockchain. WSTABLE allows stablecoins to be used in DeFi applications and can be bought, sold, and traded on digital asset exchanges.

This is just a small sample of the many wrapped tokens that are used in DeFi. It’s worth noting that the list of wrapped tokens is constantly increasing as new wrapped tokens are being created from time to time. It is important for investors to carefully evaluate the risks and potential rewards of any wrapped token before buying or investing in it.

Wrapped token development opportunities

There are a number of opportunities for the development of wrapped tokens, as mentioned below:

Wrapping traditional assets

Wrapped tokens can be used to represent traditional assets like real estate or stocks, which can allow for the creation of new investment opportunities and the ability to trade these assets in a more efficient and secure manner.

Wrapping non-fungible tokens (NFTs)

Wrapped tokens can be used to represent non-fungible tokens (NFTs), which are unique digital assets that represent ownership of a specific item or asset. Wrapping NFTs can allow for the creation of new markets and investment opportunities.

Wrapping stablecoins

Wrapped tokens can represent stablecoins, which are digital assets pegged to a specific asset or currency and designed to maintain a stable value. Wrapping stablecoins can allow for the creation of new financial instruments and investment opportunities.

Wrapping commodities

Wrapped tokens can represent commodities like gold, silver, or oil, creating new markets and investment opportunities.

Wrapping cryptocurrency

Wrapped tokens can be used to represent various cryptocurrencies, such as Bitcoin or Ethereum, which can allow for the creation of new markets and investment opportunities.

Closing note

In conclusion, wrapped tokens have the potential to significantly impact the way we think about interoperability in the blockchain world. By allowing different blockchain assets to be used in a single ecosystem, wrapped tokens open up new possibilities for cross-chain communication and collaboration. As the demand for wrapped tokens grows, we can expect to see more and more projects adopting this innovative approach to interoperability. It will be interesting to see how wrapped tokens shape the future of the crypto industry and how they may even redefine the way we think about cryptocurrency as a whole.

For thorough guidance and development of wrapped tokens, connect with our DeFi and blockchain experts!

Start a conversation by filling the form

All information will be kept confidential.

Insights

DeFi asset tokenization: Unlocking new possibilities

DeFi asset tokenization is the next step in the evolution of securitization, made possible by blockchain technology.

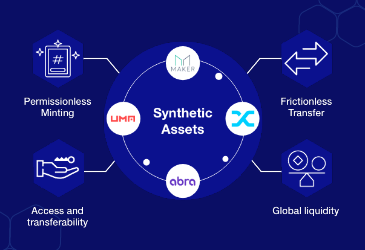

What are synthetic assets in decentralized finance

Crypto synthetic assets are gaining popularity in the crypto world as they allow investors to benefit from token fluctuations without actually owning them.

All about Blockchain Explorer

Blockchain explorer is an online tool that allows one to search for real-time information about a blockchain, such as data related to blocks, transactions, and addresses.