An Introduction to synthetic assets and their significance in DeFi

The quest for an improved financial system has always been there; DeFi is nothing but a direct consequence of that quest. DeFi is a decentralized financial setup that is based on peer-to-peer networking and self-executing smart contracts that eliminate third-party intervention completely, making the finance industry more democratic. However, with this new financial paradigm gaining steam, new forms of assets are emerging. Among these emerging assets, synthetic assets may be considered to have drawn the most attention

As we look into the future of crypto finance, synthetic assets will cater to the needs of a wider group of users. Traditional financial derivatives rely on underlying assets such as commodities, currencies, precious metals, stocks, or bonds to gain value. Synthetic assets with the same objective are not dependent on an actual asset. This means that crypto synthetic assets do not exist in the hands of investors but are cataloged, sold, and transferred online.

These digitized assets are proven genuine and issued to investors using blockchain, the underlying technology that records crypto transactions on an immutable ledger and allows coins to remain secure and traceable. The real-world asset is cataloged on the blockchain through a process called tokenization, whereby a token or digital certificate is issued to investors as a sign of ownership. The concept of digital fractional ownership can unlock a whole new world of investment opportunities by creating a digital version of real-world assets like stocks, precious metals, real estate, and commodities that are difficult to acquire.

This article explains synthetic assets and how they can accelerate the growth of decentralized finance.

- What are synthetic assets?

- Synthetic assets and DeFi: Benefiting each other

- Why are synthetic assets important?

- Top synthetic asset protocols

What are synthetic assets?

Synthetic assets, also known as crypto synths, are essentially tokenized derivatives. Let’s understand tokenized derivatives with an example. Consider a derivative whose value is linked to another asset via a contract. In that case, we can trade the movement of that value using trading products like futures.

In traditional finance, derivative value is derived from an underlying asset, such as a stock or bond. These derivatives allowed traders to speculate the price movements of an asset without actually owning it. But crypto synths or tokenized derivatives take the concept of derivatives a step further by allowing them to be recorded on the blockchain and creating a cryptocurrency token for it.

In the crypto world, crypto synthetic assets are becoming more popular since they allow investors to benefit from the fluctuation of various tokens without possessing any of them themselves. These digital assets are largely preferred for investment nowadays. This is because of two main reasons: security and traceability. Trades are recorded on a distributed ledger, guaranteeing traders anonymity and security.

Synthetic assets and DeFi: Benefiting each other

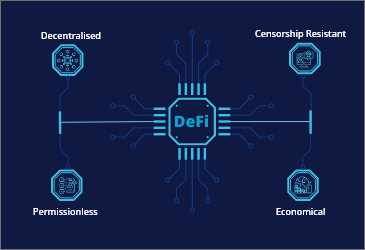

Transparency and openness are the guiding principles of decentralized finance (DeFi). Unlike traditional finance, which relies on centralized intermediaries like banks and brokerages to facilitate transactions, DeFi utilizes a public ledger to verify and record transactions directly on a digital blockchain. This eliminates intermediaries and creates a transparent and open system for all.

DeFi relies on self-executing smart contracts, which cannot be modified. When certain conditions are met, these contracts automatically activate, allowing transactions to be carried out without the involvement of a third party. For example, a smart contract could, for instance, release salary funds on payday or make payments automatically. Smart contracts guarantee the reliability of transactions due to their objective nature.

Crypto synths or synthetic assets disrupt the crypto world by allowing investors to access new and emerging crypto commodity classes. Synthetic assets, for example, can be used to tokenize bitcoin mining power, allowing everyone to participate in the bitcoin mining and earn interest without having to own and operate the equipment. Further, by staking or holding these assets for an extended period, one may also be able to obtain rewards or yield. For example, stablecoins. These coins can be staked as collateral and earn interest. This is the reason why big investors are finding these assets more attractive.

Synthetic digital assets are changing the landscape of decentralized finance or DeFi entirely. They are unlocking new opportunities for the industry by providing investors with greater access and improvised liquidity. Using smart contracts and tokenizing investments on the blockchain is increasing accessibility and democratizing the finance industry. Synthetic assets are created through smart contracts that create debt in any asset, with exchange rates determined by price oracles. Protocols are able to provide exposure to a variety of assets through a liquid market oracle in this way. Overall, the use of synthetic assets in DeFi allows for global, borderless transactions that are open and transparent, empowering investors with the autonomy to access, trade, and transfer assets easily.

Why are synthetic assets important?

The DeFi world is new, and the financial instruments are still limited in number. In the traditional finance world, investors have access to a lot of financial instruments. They have an opportunity to deploy a wide range of strategies by combing different financial instruments. Crypto synths aim to extend the availability of financial instruments and investment strategies in the DeFi world. With synthetic assets in DeFi, better risk management, increased trading volume and improved liquidity are expected to occur.

Synthetic assets protocols are also helping to mitigate challenges related to weak cross-chain communication protocols. With the help of these tokenized derivatives, users can trade in assets without having to own them. Further, it has been witnessed that crypto trading is restricted to only crypto enthusiasts or within the group of people aware of DeFi. Synthetic assets are also focusing on overcoming this limitation. This is achieved by allowing everyone to invest and participate in the traditional market without leaving the blockchain environment. Thus, with the usage of synthetic assets, the user base for cryptocurrency overall is going to expand.

These are not the only benefits these assets promise, there are many others. Let’s understand their key features and why they are gaining ground so quickly.

No counterparty involved

Synthetic assets are created through the process of minting, which involves locking up a higher value of cryptocurrency as collateral. When these assets are traded against each other, the “sold” asset is burned, and an equal value of the “buy” asset is minted. This process allows for the exchange of value between synthetic assets without the need for a physical exchange or a counterparty. As a result, order books, which are platforms where buyers and sellers of an asset can meet at a specific price, are not necessary for synthetic assets. Instead, the value of the assets can be transferred directly through the minting and burning process. This can streamline the trading process and make it more efficient for investors.

Decentralized

Synthetic asset exchanges can mint a virtually unlimited supply of any asset as long as it is sufficiently collateralized. This means that the exchange can create as many tokens as it wants as long as an equivalent value of the collateral backs the total value of the tokens. Synthetic asset exchanges are non-custodial, meaning they do not hold assets on behalf of their users, and there are no brokers or know-your-customer (KYC) systems involved. This can make synthetic asset exchanges a more decentralized and cost-effective way to trade, as there are very few fees associated with using these platforms.

Increased flexibility

Synthetic assets allow investors to gain exposure to a wide range of assets, including stocks, bonds, commodities, and currencies, without directly purchasing the underlying asset. This allows investors to customize their portfolios and tailor their investments to their specific financial goals.

Enhanced risk management

Synthetic assets can be used to hedge against market risks, such as currency or commodity price fluctuations. This can help investors to protect their portfolios and reduce the overall risk of their investments.

Lower transaction costs

Because synthetic assets are created through financial contracts rather than physical purchases, they can often be traded at a lower cost than traditional assets. This can make them an attractive option for investors looking to reduce the costs associated with their investments.

Increased liquidity

These assets can offer more liquidity than traditional asset exchanges and lower underlying costs for traders. This is because synthetic asset exchanges do not have the same price spreads or trading fees as regular asset exchanges, making it easier for traders to buy and sell assets and potentially realize a profit. Synthetic assets can be an attractive option for traders who are looking to speculate on the movement of asset prices without incurring high fees or spreads.

Greater accessibility

Synthetic assets can be purchased by investors who may need more capital to purchase the underlying asset directly. This can make it easier for investors with smaller budgets to gain exposure to a wider range of assets.

Top synthetic asset protocols

As the popularity of synthetic assets has grown, more decentralized finance (DeFi) solutions have emerged to meet the demand. Synthetic asset exchanges, which allow traders to buy and sell synthetic assets, have become increasingly popular on various blockchains. Synthetix is one of the most well-known synthetic asset exchanges, having been one of the first platforms specifically designed for trading tokenized derivatives. Other popular synthetic asset exchanges include MakerDAO. This exchange offer traders a range of options for buying and selling synthetic assets, along with lower gas fees and increased flexibility.

Synthetix

Synthetix is a decentralized finance (DeFi) protocol that enables the creation and trading of synthetic assets on the Ethereum blockchain. Like traditional finance derivatives, synthetic assets derive their value from crypto and real-world assets. Synthetix’s native token, SNX, can be used as collateral against synthetic assets and helps secure the Synthetix network through staking.

The Synthetix protocol allows users to create a wide range of synthetic assets by collateralizing their assets. Traders can then trade these synthetic assets on Synthetix’s decentralized exchange (DEX), Kwenta, for other crypto and real-world assets, such as gold. To use Synthetix, users must deposit their tokens on DeFi platforms like Curve or Uniswap, as the protocol is built on the Ethereum blockchain.

In 2020, Synthetix shifted governance from a not-for-profit foundation to three decentralized autonomous organizations (DAOs). As a leading synthetic asset protocol, Synthetix aims to provide users with censorship-resistant access to a wide range of assets.

UMA

UMA is a decentralized platform for financial contracts that utilizes smart contracts and a “provably honest oracle” mechanism to enable any two parties to establish financial contracts on their own terms. Investors can create their own tokenized derivatives, similar to exchange-traded funds (ETFs), on the platform using ERC20 tokens, providing short, long, or leveraged exposure to real-world assets.

One of the goals of UMA is to increase the adoption of crypto in the derivatives market by providing retail investors with a way to buy synthetic assets representing the underlying value from a transparent, open-source protocol. By leveraging Ethereum’s smart contracts and incentive mechanisms, UMA provides a secure and trustless way for users to create custom financial contracts and launch ERC-20 tokens on the Ethereum blockchain without the need for legal frameworks or intermediaries.

Abra

Abra is a decentralized investment platform founded in 2014 and has played a pioneering role in using synthetic assets in the crypto industry. It allows users to purchase, sell, and hold alternative cryptocurrencies by creating synthetic assets. Using Abra, fiat currencies are converted into crypto assets. This conversion process involves pegging the crypto asset to a different asset class, such as fiat currency.

MakerDAO

Like Abra, MakerDAO allows investors to gain exposure to the value of traditional assets, such as the US dollar, using cryptocurrencies as collateral. In the case of MakerDAO, investors can use Ethereum as collateral to mint a synthetic asset called DAI. DAI is an Ethereum-based stablecoin pegged to the US dollar’s value. Users can create DAI by collateralizing their cryptocurrency asset in a smart contract on the MakerDAO platform. The value of the DAI is then maintained through an automatic mechanism called the “Stability Fee,” which adjusts the DAI supply in response to market conditions changes. This process allows holders of Ethereum to benefit from the price fluctuations of the US dollar.

Conclusion

Synthetic assets are an evolution of traditional derivatives with greater flexibility and versatility than the latter. While derivatives provide customized exposure to various assets, synthetic assets enable investors to trade almost anything imaginable.

In addition to their diverse applications, synthetic assets and the models that power them can revolutionize finance by allowing investors to trade traditional assets and their derivatives within the digital ecosystem. They also leverage the benefits of decentralization to open up new opportunities for thousands of investors.

As the market value of crypto synthetic assets continues to grow, these assets are likely to become increasingly popular among investors seeking to mitigate risk and deploy a wide range of investment strategies on a diverse set of assets. This trend is likely to drive increased volume in crypto trading and attract traditional investors to the world of decentralized finance.

If you want professional development services for tokens, LeewayHertz is the ideal choice. Our expert developers are proficient in creating a wide range of tokens.

Start a conversation by filling the form

All information will be kept confidential.

Insights

DeFi asset tokenization: Unlocking new possibilities

DeFi asset tokenization is the next step in the evolution of securitization, made possible by blockchain technology.

Wrapped tokens: An innovative approach to interoperability

Learn how wrapped tokens play a critical role in enabling cross-chain interoperability and in providing new financial services within the blockchain ecosystem.

All about Blockchain Explorer

Blockchain explorer is an online tool that allows one to search for real-time information about a blockchain, such as data related to blocks, transactions, and addresses.