A complete guide to Defi Yield Farming Development

Every industry remains inescapable with the evolutionary process. With so much buzz around rising trends, the world is witnessing that the crypto space has reshaped every aspect to grow and build a better economy. The introduction of DeFi technology is one of the most forefronts of innovation in the blockchain space. It has driven the financial industry with sheer innovation and flexibility compared to traditional finance. One of such emerging trends in the crypto world that has grabbed the attention of many cryptocurrency enthusiasts is yield farming. While exploring to invest in specific cryptocurrencies and looking to churn out a significant profit, yield farming serves as the better option.

The need for a transparent financial system is the driving key to sprang the DeFi. It is a blockchain-enabled concept that gives advanced and agile tools to users, reducing operational risk associated with a traditional finance model. Another compelling aspect of DeFi is the yield generated by various platforms, which pay over 1 billion dollars per day to yield farming participants without any indications of slowing down. DeFi pulse estimated that 95% of the USD 41.5 billion total value locked (TVL) in the DeFi economy is attributed to yield farming. The CoinMarketCap data states that the total locked value of liquidity pools in yield farming projects reached beyond 13 billion dollars in March 2021.

This article will help to explore the fundamentals associated with DeFi yield farming. It focuses on answering some of the following significant questions related to DeFi yield farming.

- What is DeFi Yield Farming?

- What makes DEFI more suitable for Yield farming?

- How does DeFi Yield Farming work?

- What are the Platforms and Protocols of DeFi Yield Farming?

- What are the benefits of DeFi Yield Farming?

What is DeFi Yield Farming?

Yield farming is a way of earning rewards with cryptocurrency holdings. Staking or lending crypto assets within DeFi protocols to produce high returns in interest, incentives or additional cryptocurrency is known as DeFi yield farming. The term farming implies the high interest produced via the liquidity of different DeFi protocols. Along with rewards, DeFi protocols issue tokens that represent user’s share in the liquidity pool, which are moveable to other platforms for increasing their potential gains.

Yield farming is beneficial to lenders as well as borrowers. A liquidity pool can be a valuable source for borrowers looking for margin trading, while lenders can invest their idle crypto assets in their wallets to generate a passive income. In a DeFi ecosystem, yield farmer performs the role of banks to lend funds for using the tokens to yield maximum returns. The entire ecosystem runs with the help of blockchain-based smart contracts, connecting the borrowers and lenders while handling the investors’ rewards.

Following are some of the essential terms associated with DeFi Yield Farming.

-

Liquidity

Liquidity refers to the conversion of assets into cash. When assets are bought or sold, the market becomes competitive in the crypto globe. - Liquidity Pool

Liquidity pools refer to the pools of tokens or assets, which offer better returns to users than money markets. They are smart contracts that carry or lock up the assets to facilitate trading through high liquidity provision. These pools are helpful for different platforms to offer necessary liquidity in various cryptocurrencies. Liquidity pools need liquidity providers to function correctly.

Liquidity providers stake their holdings in liquidity pools to receive rewards generated by the DeFi platform. These rewards or earnings come from the fees generated by the DeFi platforms. Some liquidity pools pay their rewards in the form of multiple tokens. These reward tokens are further deposited to other liquidity pools for earning additional rewards. Uniswap and Balancer DeFi platforms are regarded as the most extensive liquidity pools offering rewards to liquidity providers for adding their assets to the pool. - Liquidity Pool Providers

Yield farming is not feasible without liquidity providers. The users who stake their deposits or invest their assets in the pool of funds are known as liquidity providers. They are also known as market makers as they supply what buyers and sellers need to trade. The assets in liquidity pools are lent with a smart contract where a buyer and seller agreement is coded and opened in the DeFi blockchain platform.

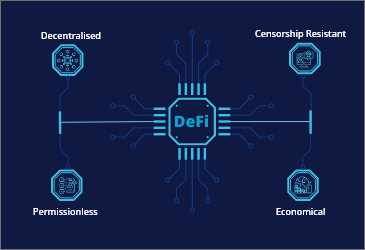

What makes DeFi more suitable for Yield Farming?

Unlike the traditional financial system that runs on centralized infrastructure governed by central authorities, institution intermediaries, DeFi is powered by code that runs on the decentralized infrastructure of blockchain. The immutable smart contracts help the DeFi developers to launch and run the financial protocols and platforms in a programmable way.

The concept of yield farming emerged due to decentralized finance. Due to the decentralized nature of DeFi, no centralized entities provide seed capital. Hence, all cryptocurrencies are supplied to DeFi platforms by lenders and liquidity providers. These DeFi platforms are software-based brokers who facilitate financial transactions in exchange for a small fee.

DeFi leverages the significant features of blockchain to unlock liquidity, enhance financial security and support standardized economic systems. The key features of DeFi that make it suitable for carrying out yield farming are stated below.

- Immutability

As DeFi is based on blockchain technology, the entire data remains unalterable. The tamper-proof information makes the financial transactions more secure and conveniently auditable. - Programmability

Highly programmable smart contracts automate execution and the creation of digital assets. - Interoperability

DeFi protocols and applications are built-in combination and integration. With DeFi, developers have the flexibility to build on top of existing protocols, customize interfaces, and integrate third-party applications. Hence, DeFi protocols are also known as “money legos.” - Transparency

As DeFi functions on blockchain technology, it offers a great deal of transparency in all transactions, data and codes. This level of transparency and authenticity around transaction data builds trust and ensures that network activity is available to any user. DeFi protocols are designed with open source code available for anyone to view, understand and audit. - Permissionless

DeFi enables open and permissionless access. It implies that anyone with a crypto wallet can access DeFi applications irrespective of their location and the required funds. - Self-Custody

DeFi market participants can keep custody and control of their assets and data. They can interact with permissionless financial applications and protocols through the usage of web 3 wallets like Metamask.

Comprehensive development services to help you lead the future-ready DeFi projects.

Launch your DeFi project with LeewayHertz

How does DeFi Yield Farming work?

Yield farming in decentralized finance applications provides trustless opportunities for crypto holders to make passive income and returns by lending their holdings via smart contracts. Every Defi application differs in terms of characteristics and functionalities. The uniqueness of the DeFi application decides how the yield farming will take place on its platform.

Yield farming majorly involves the role of liquidity pools and liquidity providers. A user who deposits the cryptocurrencies in the smart contract is known as Liquidity Provider, while smart contracts are nothing but liquidity pools. These pools exist on specialized decentralized exchanges known as Automated Market-Maker (AMM). For example, the platforms like Uniswap, Curve and Balancer allow traders to swap tokens by depositing one token into the pool and getting the proportionate amount of the other in exchange. They pay a small fee to execute the transaction, which gets distributed into the entire liquidity pool. Liquidity providers earn this fee.

Here’s a detailed workflow of DeFi yield farming.

Step 1: Liquidity provider deposits their funds into liquidity pools, which are essentially smart contracts. Deposited funds usually are stablecoins pegged to USD, such as DAI, USDT, USDC, and more. These funds are locked by smart contracts and become available under smart contract limitations and yield farming platforms.

Step 2: These liquidity pools control a marketplace for the users to exchange, borrow and lend funds. The users using the DeFI platform pay the fees. In this way, liquidity providers can avail of the benefit of earnings according to the value of their funds.

Step 3: The liquidity providers are rewarded with fees in return for locking up their funds in the pool. The returns are generated in funds or tokens depending upon the invested amount and the platform’s protocols.

Step 4: The rewarded funds or tokens get deposited in liquidity pools. The liquidity providers grab this opportunity to create complex investments by reinvesting and shifting the rewarded tokens into other liquidity pools to reap more yields. It will help the LP in diversifying its cryptocurrency asset portfolio. Employing a proper strategy will ensure that they have maximum benefits from yield farming.

Hence, it infers how a more active pool can generate more fees for liquidity providers. The funds deposited in yield farming are mostly stablecoins pegged to USD. DAI, USDT, BUSD.

How to calculate returns in DeFi yield farming?

When it comes to calculating returns for liquidity providers, the following metrics play a crucial role.

- Total Value Locked (TVL)

TVL is a parametric value that measures crypto locked in DeFi lending and other marketplaces. Tracking the total value of cryptocurrencies locked in smart contracts of various platforms provides a complete overview of their performance. It assists the participants in comparing different DeFi platforms and protocols in terms of their market share.TVL serves to be an efficient way of collecting liquidity in liquidity pools and exhibits a measurable approach to the volume of the DeFi and yield farming market as a whole. - Annual Percentage Yield (APY)

It represents the annual rate of return imposed on borrowers and paid to providers subsequently. - Annual Percentage Rate (APR)

It represents the annual rate of return imposed on the capital borrowers but paid to the capital providers.

The returns in DeFi Yield farming are estimated on an annual basis. The crucial parameters associated with calculating returns in yield farming are Annual Percentage Rate (APR) and Annual Percentage Yield (APY).

APR and APY differ from each other in terms of compounding effect. Compounding refers to the strategy of reinvesting profits to acquire maximum returns. APY accounts for the compounding effect, while APR does not take into account the compounding effect.

As APR and APY come from legacy markets, DeFi must find its metrics to calculate returns in yield farming. Simple staking procedures provide up to 10% of annual returns, while yield farmers can adopt complex trading strategies to provide more than 50% returns annually.

How do yield farmers earn a return on investment?

In yield farming, the return on investment falls into the following three categories.

- Transaction fee income

Transaction fees show variation with different protocols and pools. For example, the fee set at the stage of pool creation by the user in the Balancer pool shows variation between 0.001% and 10%. Other pools like Uniswap charge a flat fee of about 0.03%. All fees are passed to liquidity providers. Hence, it is likely that governance token holders will receive a portion of the proceeds in the future. - Token rewards

Token rewards are used in the form of incentives to offer liquidity. These rewards get distributed over a specific period of weeks, months or even years. The tokens rewarded are often used to govern the system during issuance at any time. These tokens are traded on decentralized exchanges as well as on some centralized exchanges like Coinbase. - Capital growth

Capital growth helps to compute the profitability of any challenging yield farming opportunity. When the yield farming strategy involves BTC, REN, SNX and CRV assets, they become volatile and can move without correlation. Therefore, it is essential to adopt yield farming strategies that align positively with involved tokens like stablecoins to avoid volatility.

What are the Platforms and Protocols of DeFi Yield Farming?

There are numerous yield farming platforms and protocols available in the DeFi market. Each platform governs its own rules and risks with different yield farming strategies. Here are some of the widely used DeFi yield farming platforms.

- Compound Finance

It serves to be the core protocol of the yield farming ecosystem. It is a well-known DeFi based protocol that enables users to lend and borrow assets. Any user with an Ethereum wallet can provide assets to compound liquidity pools of the compound and earn the rewards. - Yearn.Finance

It is a decentralized platform that undergoes the conversion of funds into yTokens. (yTokens are liquidity tokens that are given in exchange for investor’s deposits on Yearn.Finance platform). It also helps in periodical rebalancing to gain maximum profit. This lending platform helps the users to choose the best strategies automatically. Its main objective is to optimize token lending by finding the most profitable lending services. - Uniswap

It is DeFi based DEX platform that allows users to swap tokens due to its frictionless nature. These easy and trustless token swappings assist the yield farmers in executing their strategies. On this platform, liquidity providers deposit two tokens holding an equivalent value for market creation. Traders perform trading into this liquidity pool and liquidity providers are rewarded with fees on trades in the pool. - Aave

It is an open-source, non-custodial and widely used decentralized lending platform by yield farmers where the interest is automatically adjusted according to current market conditions. After depositing the funds, the lenders receive tokens in return for their funds. These tokens play a vital role in facilitating immediate earnings and compounding interest on the deposited amount. This platform also offers other advanced functionalities like flash loans. - Balancer

It is a multi-token automated market-making protocol allowing custom token allocation in the liquidity pool. With this protocol, liquidity providers can create and customize balancer pools and earn profitable fees from the execution of trades. Due to the flexibility of creating a liquidity pool, yield farmers have widely adopted balancer protocols to optimize their work. It is similar to Uniswap and curve protocols, with the only difference that it offers flexibility in customizing token allocations in the liquidity pool. - Curve Finance

It is an Ethereum based decentralized exchange protocol specifically designed to carry out high-value swaps with stablecoins with low slippage. It also supports DAI, USDC, TUSD, and BTC pairs, enabling users to trade swiftly and smoothly between these pairs. - MakerDAO

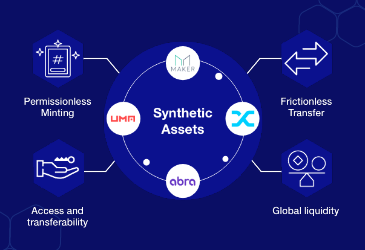

It is supposed to be one of the first DeFi projects incorporating a decentralized lending platform to support the creation of DAI, a stablecoin linked to the USD value. The platform is developed on the Ethereum blockchain, where Ethereum smart contracts manage the crypto loans. The users can lock collateral assets such as USDC, ETH, WBTC, or BAT in a Maker Vault to generate DAI against the collateral they have locked in the vault. This debt incurs interest over time, known as stability fee, whose rates are set by MKR token holders. - Synthetix

It is a synthetic protocol that allows for the issuance of synthetic assets on the Ethereum blockchain. It supports various synthetic commodities with a reliable price feed, including gold, silver, synthetic cryptocurrencies, and synthetic fiat currencies.

Comprehensive development services to help you lead the future-ready DeFi projects.

Launch your DeFi project with LeewayHertz

What are the benefits of DeFi Yield Farming Development?

DeFi yield farming offers multiple benefits. Some of them are listed below.

- Easy User Interface

Investors make use of various apps for monitoring their investments. Hence, they hardly find any learning curve with these yield farming applications. The apps are built with user-friendly interfaces to help the users check the availability of projects that require staking and selecting the cryptocurrency amount for contribution. - Easy start

Users can quickly start with yield farming due to the high interoperability of DeFi platforms. Ethereum and cryptocurrency wallet are the only two essential requirements. - Profit Potential

The participants who stake their cryptocurrencies earlier into protocols can acquire profitable returns. - Interoperability

The DeFi sector is highly interoperable and versatile. Some DeFi platforms stake the crypto and automatically move it from platform to platform to impart better investment outcomes.

Yield farming gained enormous attention, being one of the most lucrative, highly profitable types of crypto investment with high liquidity. Due to increasing adoption among users and easing regulations around the investment strategy, yield farming is acquiring its renown and prominence with each passing day.

The rising trends of the DeFi platform mode continue to exhibit explosive growth in the enthusiastic participation of large investors and crypto-asset holders in the future. Keeping in mind the profitable returns occupied through yield farming, it beholds a promising future and proliferative ways of money-making practices in the near and long term.

We at LeewayHertz offer the best DeFi-based yield farming development services. With a concise understanding of DeFi Yield Farming, our DeFi experts provide the best solutions to launch your DeFi yield farming platforms or even integrate DeFi based yield farming protocols in your existing platform.

If you are still not clear how DeFi yield farming can assist you in making more money, feel free to catch our experts and schedule a meeting to discuss your business requirements.

Start a conversation by filling the form

All information will be kept confidential.

Insights

DeFi asset tokenization: Unlocking new possibilities

DeFi asset tokenization is the next step in the evolution of securitization, made possible by blockchain technology.

Wrapped tokens: An innovative approach to interoperability

Learn how wrapped tokens play a critical role in enabling cross-chain interoperability and in providing new financial services within the blockchain ecosystem.

What are synthetic assets in decentralized finance

Crypto synthetic assets are gaining popularity in the crypto world as they allow investors to benefit from token fluctuations without actually owning them.